Jewellery constitutes nearly half of gold mined so far. To be more specific, it is 86 thousands of tons. Moreover, official reserves, private investments and industrial production are also available. The level of supply for gold depends on many factors but a situation on financial markets has a major influence on this resource. The demand […]

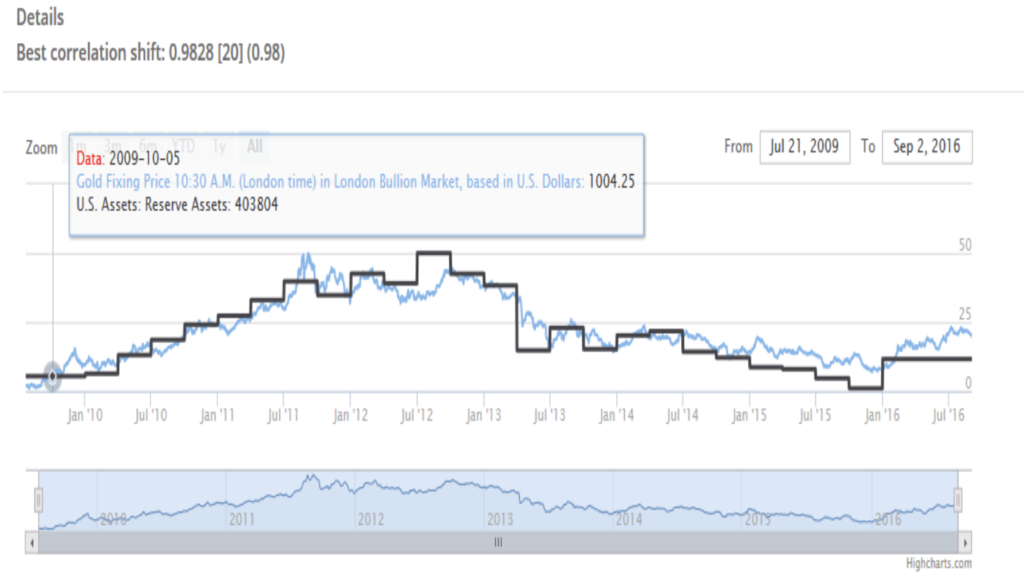

Jewellery constitutes nearly half of gold mined so far. To be more specific, it is 86 thousands of tons. Moreover, official reserves, private investments and industrial production are also available. The level of supply for gold depends on many factors but a situation on financial markets has a major influence on this resource. The demand for gold rises when risk soars and market situation is perceived as beginning of crisis. Gold, just like bonds, is a safe deposit. Individual investment provisions and funds grow. However, many owners of gold are forced to sales when the crisis keeps expanding. Consequently, the supply at the secondary market increases and the prices fall. It also goes hand in hand with the decrease in employment. As a result, in case of many producers the prices reach the level of a price floor of mining. They decide to limit mining or close some of mines. After some time the prices rise again. These situations are illustrated on our charts but, as well, they present something slightly different.