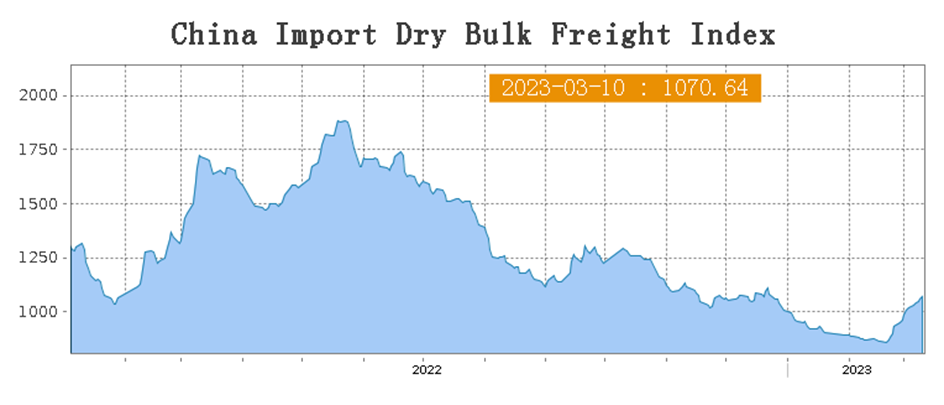

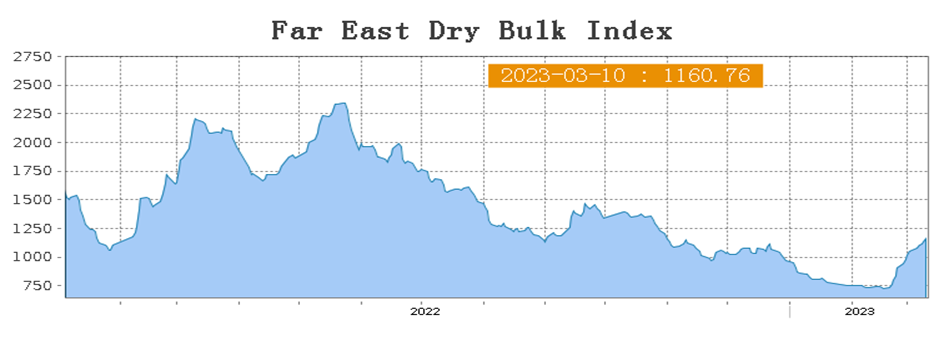

One of the first signs of a recovery in China’s economy may be maritime freight rates. Since mid-2022, rates in most shipping sectors to and from China have been recording sharp declines. The beginning of 2023 brought the first signs of a change in this trend, but these only apply to certain types of ships. […]

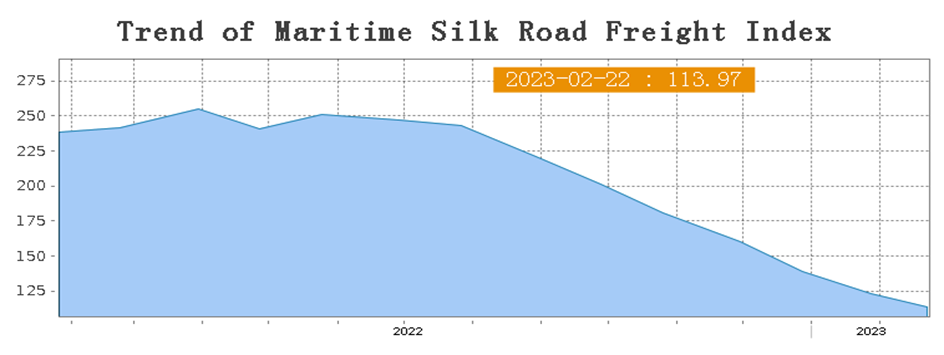

One of the first signs of a recovery in China’s economy may be maritime freight rates. Since mid-2022, rates in most shipping sectors to and from China have been recording sharp declines. The beginning of 2023 brought the first signs of a change in this trend, but these only apply to certain types of ships.

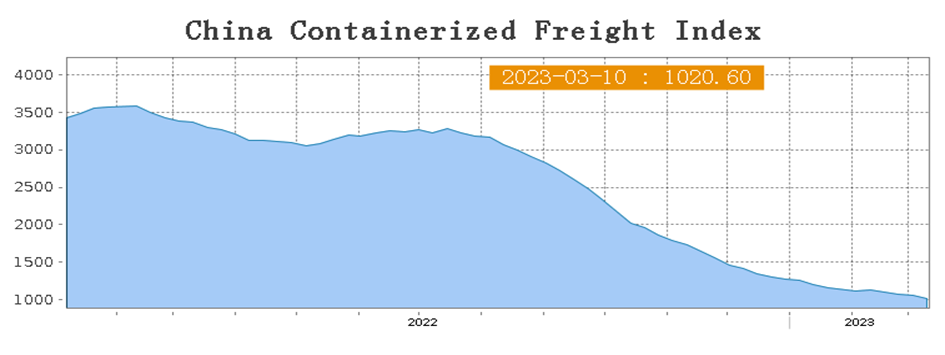

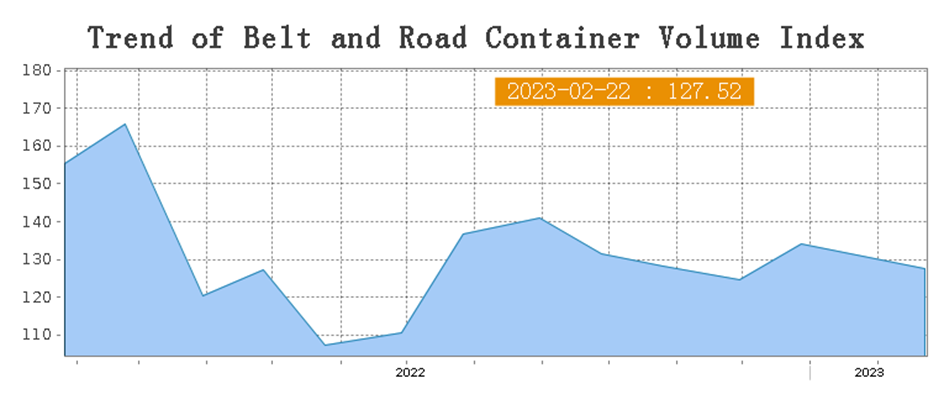

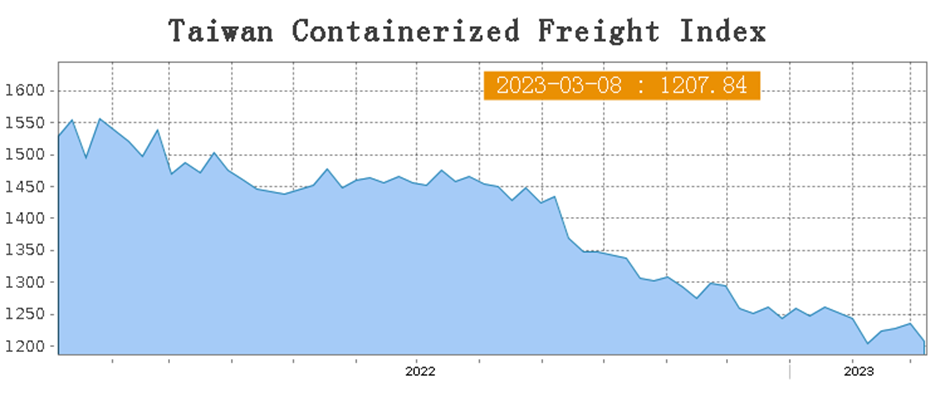

In order to talk about stronger signs of recovery in the overall economy, it would be necessary to note a reversal of the downward trend in container freight rates, since container ships are the most important means of sea transportation for highly processed products.

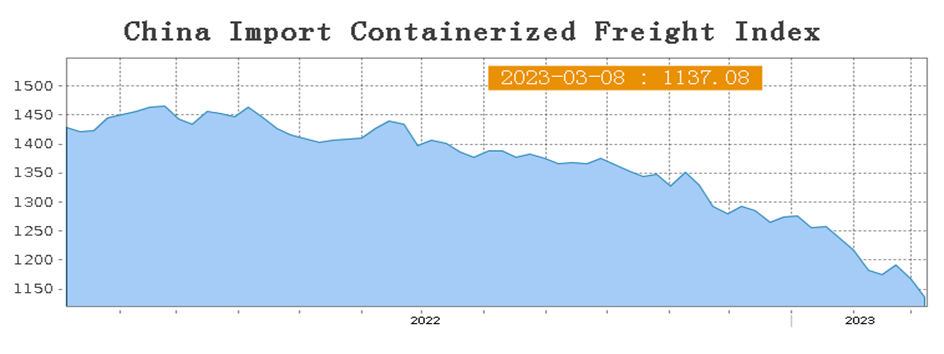

There has been no reversal of the downward trend in container freight to and from China.

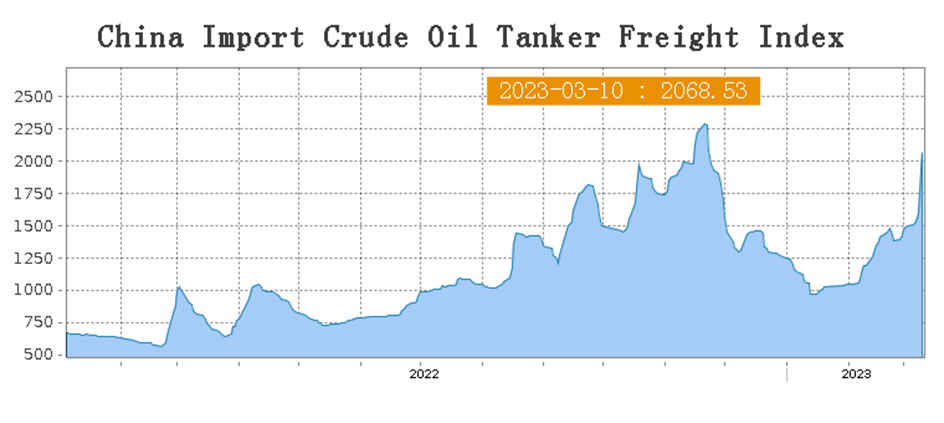

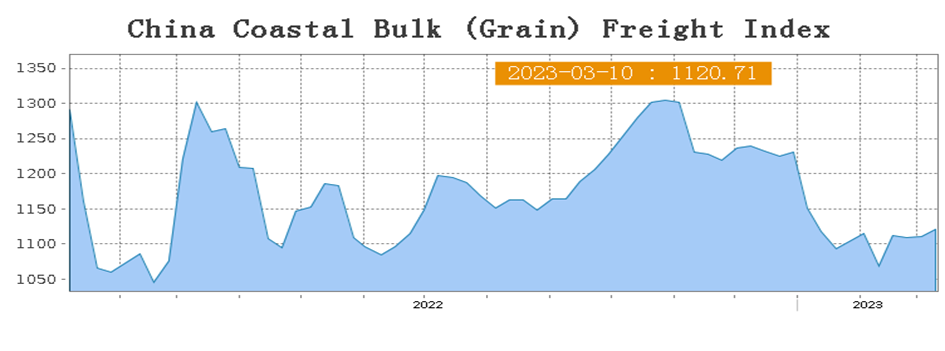

However, there was a marked increase in rates for crude oil tankers and coal bulk carriers (in coastal transport). In addition, in February 2023, there was a demand for grain shipping ships, resulting in a slight increase in freight rates in this sector as well.

At the moment, therefore, it is still difficult to talk about signs of recovery in the Chinese economy based on indications from the analysis of ocean freight. Nevertheless, ongoing monitoring and analysis of this area seems essential to grasp the turning point.

An overview of Chinese ocean freight rate indexes for different types of ships.

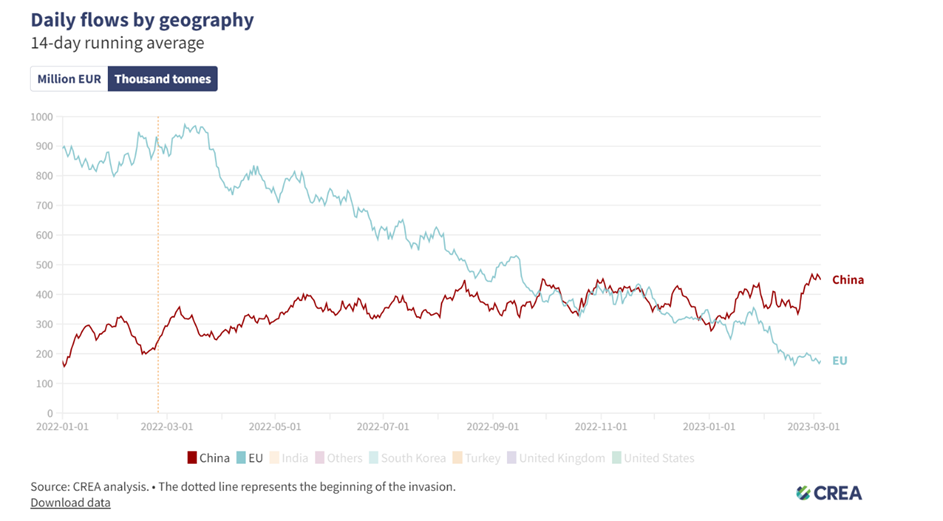

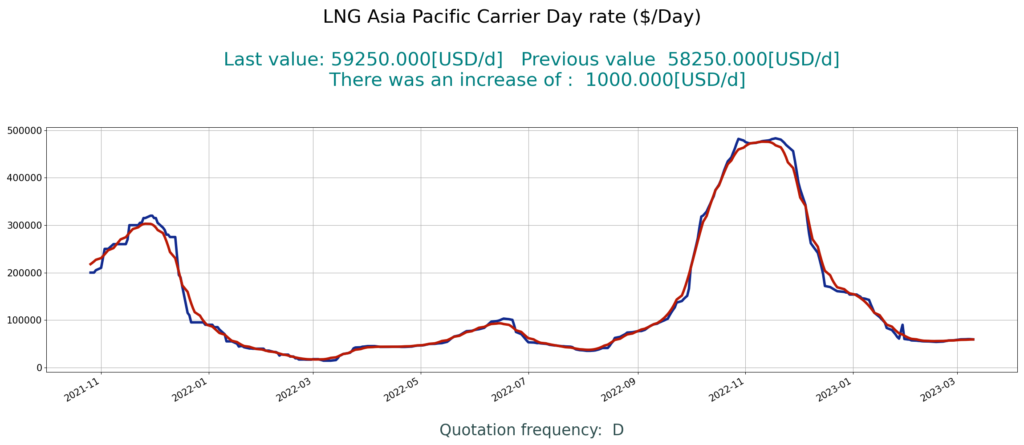

The largest increase in rates has been recorded since the beginning of 2023 in the oil tanker segment, which can be linked to, among other things, increased purchases of Russian oil at prices markedly lower than in Europe.

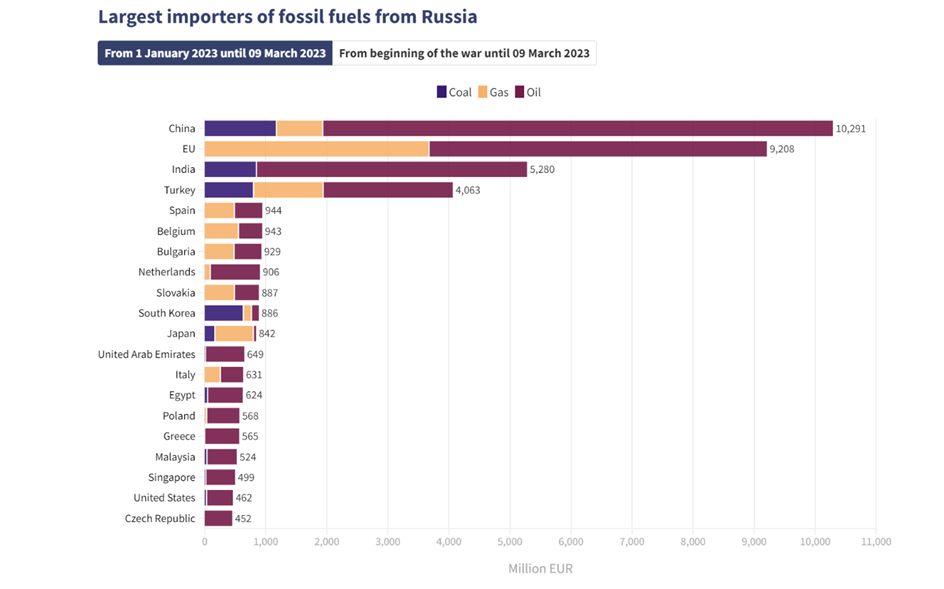

In recent days, China has imported the most fossil fuels from Russia since the start of the war in Ukraine.

The vast majority of fuel imports from Russia (also by volume – in tons) is crude oil.

Attractive Russian oil prices are probably not the only reason for increased imports.

The needs of the real economy may also already be gaining ground, as evidenced by the shrinking oil stocks controlled by the Shanghai Stock Exchange in recent days (especially low-sulfur oil stocks):

| 2023-03-03 | China Warehouse Stock: Shanghai Futures Exchange: Low Sulfur Fuel Oil (Ton) | 27330.00 |

| 2023-03-06 | China Warehouse Stock: Shanghai Futures Exchange: Low Sulfur Fuel Oil (Ton) | 25140.00 |

| 2023-03-08 | China Warehouse Stock: Shanghai Futures Exchange: Low Sulfur Fuel Oil (Ton) | 14140.00 |

| 2023-03-10 | China Warehouse Stock: Shanghai Futures Exchange: Low Sulfur Fuel Oil (Ton) | 2160.00 |

| 2023-03-03 | China Warehouse Stock: Shanghai Future Exchange: Fuel Oil (Ton) | 35240.00 |

| 2023-03-06 | China Warehouse Stock: Shanghai Future Exchange: Fuel Oil (Ton) | 35240.00 |

| 2023-03-08 | China Warehouse Stock: Shanghai Future Exchange: Fuel Oil (Ton) | 26340.00 |

| 2023-03-10 | China Warehouse Stock: Shanghai Future Exchange: Fuel Oil (Ton) | 24570.00 |

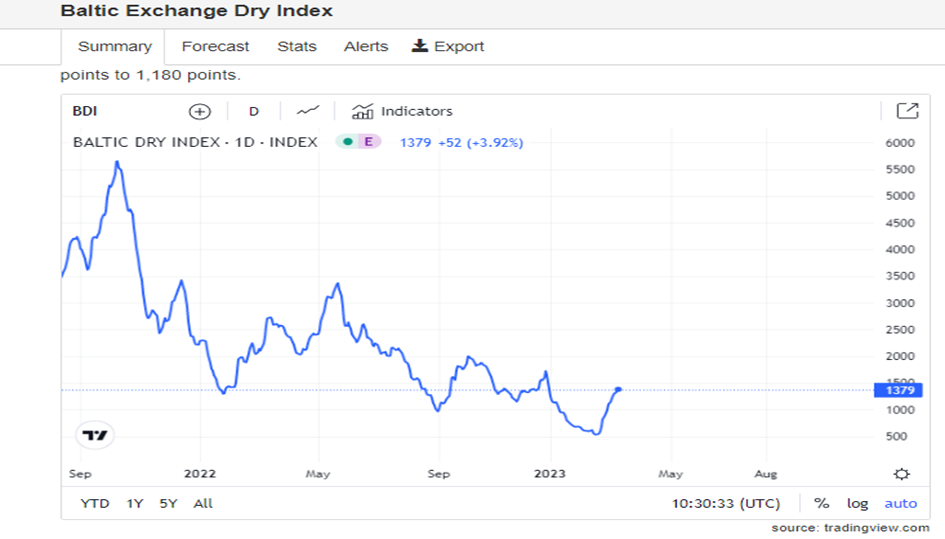

Bulk carriers, including coal carriers and vessels transporting grain, are also seeing a marked increase in freight rates:

In February 2023, overall demand for thermal coal in China began to decline, but the reopening of some small power plants has brought increasing activity in the coastal shipping market leading to a recovery in freight rates:

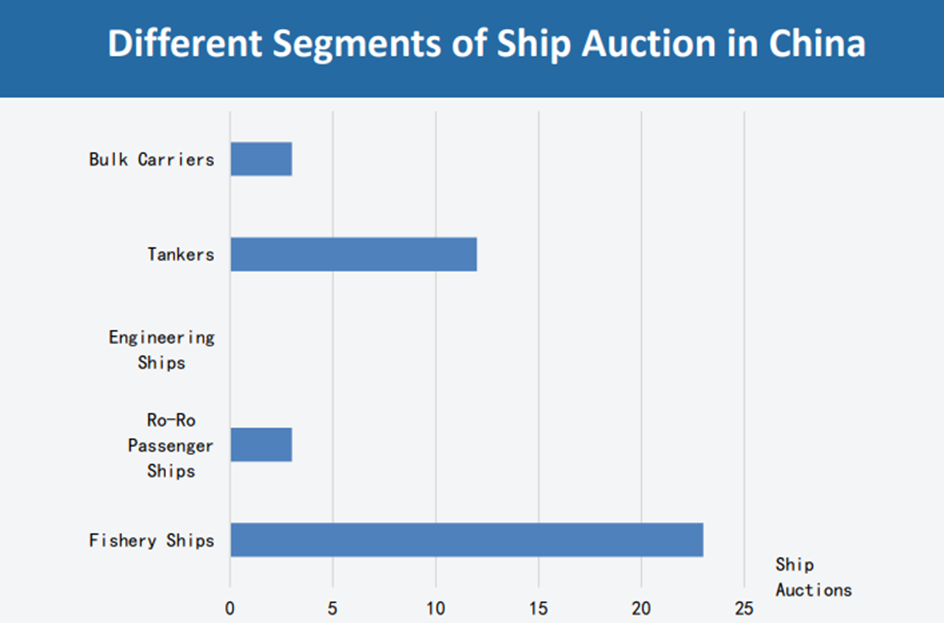

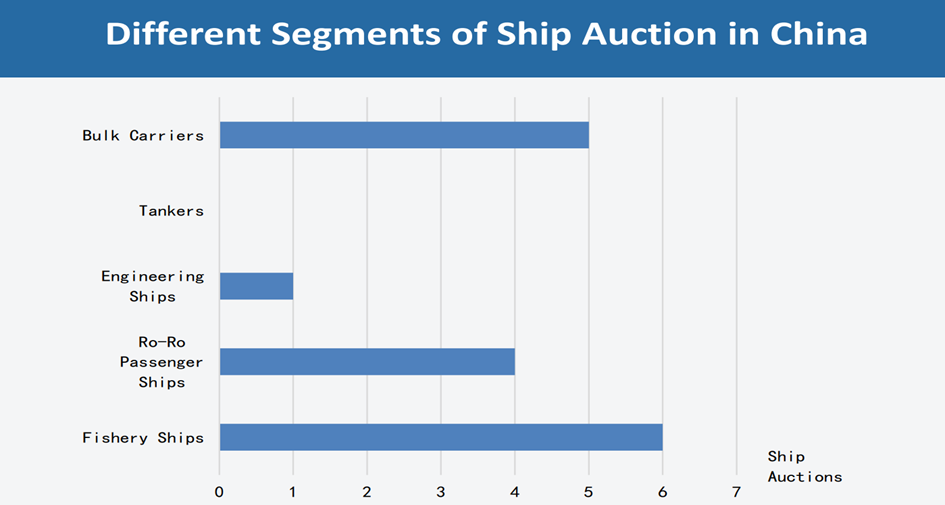

International trade has seen new opportunities in the grain market, resulting in an increase (still relatively small for now) in freight rates, especially for Panamax and Supramax ships. The growing demand for grain transportation has fostered the search for relatively small bulk carriers at monthly ship auctions in China.

For now, there has been no reversal of the downward trend in container freight to and from China.

At the moment, it is still difficult to talk about signs of recovery in the Chinese economy based on indications from the analysis of ocean freight. Nevertheless, ongoing monitoring and analysis of this area seems essential to grasp the turning point:

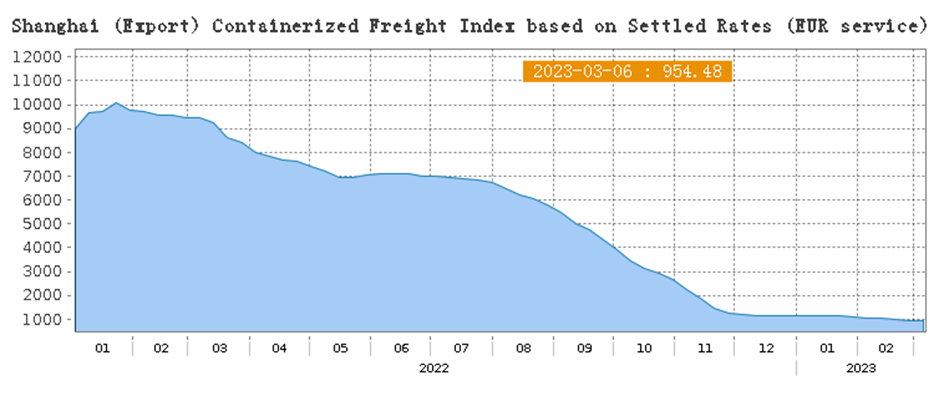

Freight rates for seaborne exports from China are not increasing for now, regardless of the direction:

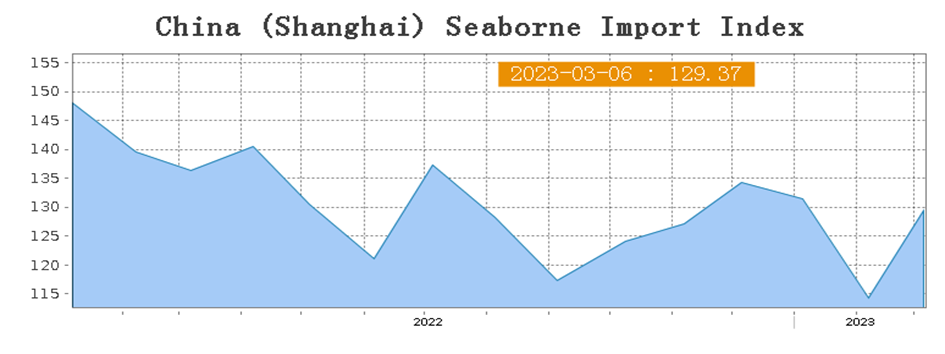

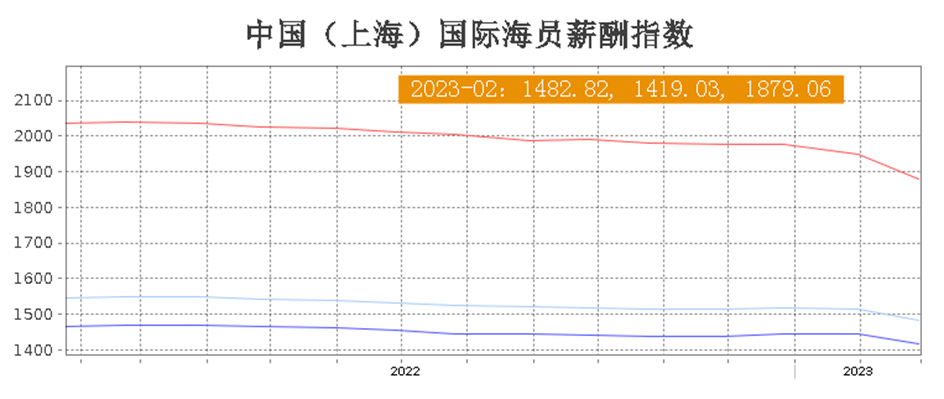

Freight rates in other shipping sectors in China:

The index of Chinese crew salaries – regardless of occupational group (officers, engineers, mechanics, sailors, etc.) – for the time being wage rates are not increasing:

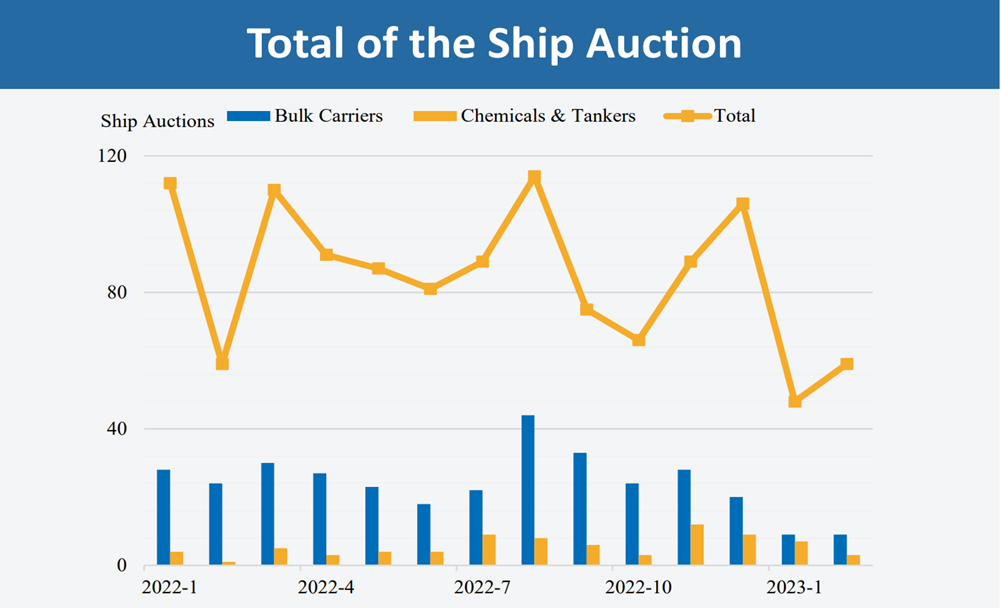

China’s ship auction market.

In January, shipping demand was generally low, as were freight rates. As for coastal shipping, stocks of power plants were sufficient, so they were replenished and required only minor replenishment. Combined with the closure of factories for the vacation season, overall freight rates fell.

The number of ship auction transactions declined, but the transaction price increased month by month. In January, 48 ships were auctioned. Twenty-three were sold with a transaction rate of 47.9%.

The total asking price was about 356.65 million yuan, while the total transaction value was 268.09 million yuan.

In February, business and production gradually recovered from the vacation season, and market activity picked up. However, the market was oversupplied with capacity in most segments.

In February, the total asking price at ship auctions was about 571.64 million yuan (up 214.99 million yuan m/m, but down 25.09 million yuan y/y) . The total value of transactions was 170.83 million yuan, (down 97.27 million yuan m/m, but up 27.49 million yuan y/y).

Ship types sought for auction – January 2023:

Ship types sought for auction – February 2023:

Other ocean freight rates quoted currently:

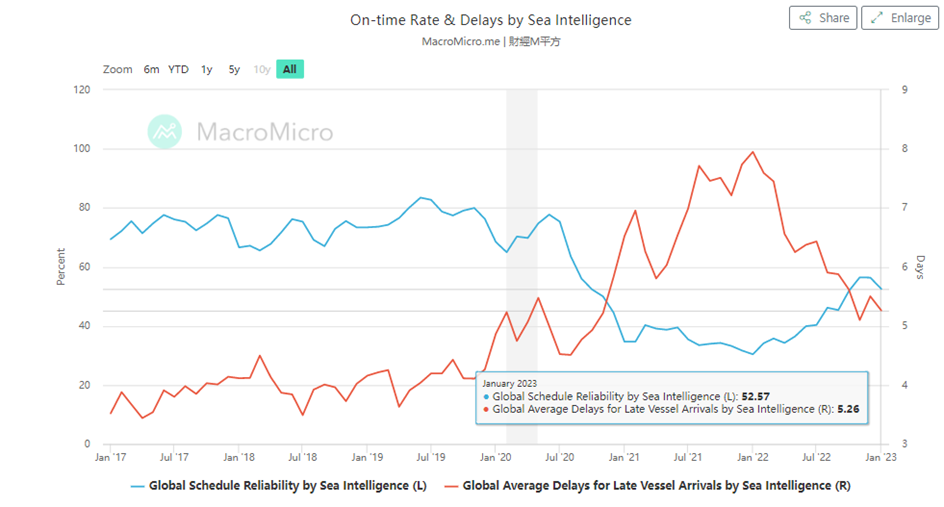

Reliability and average delay in shipping:

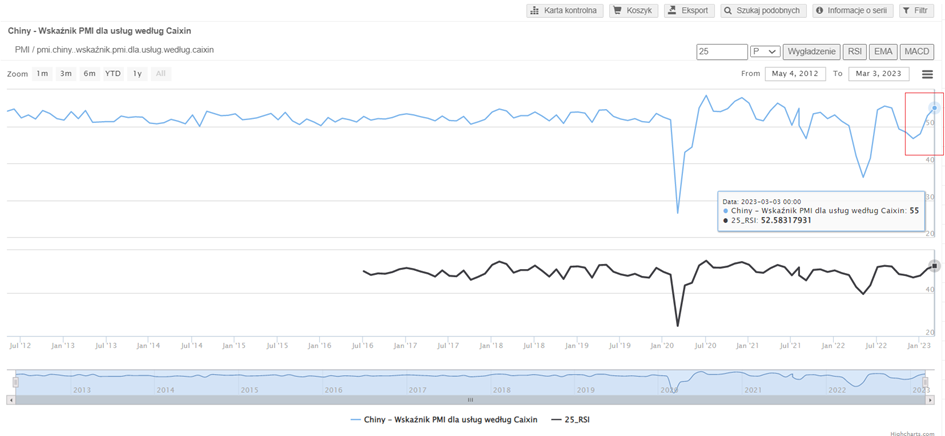

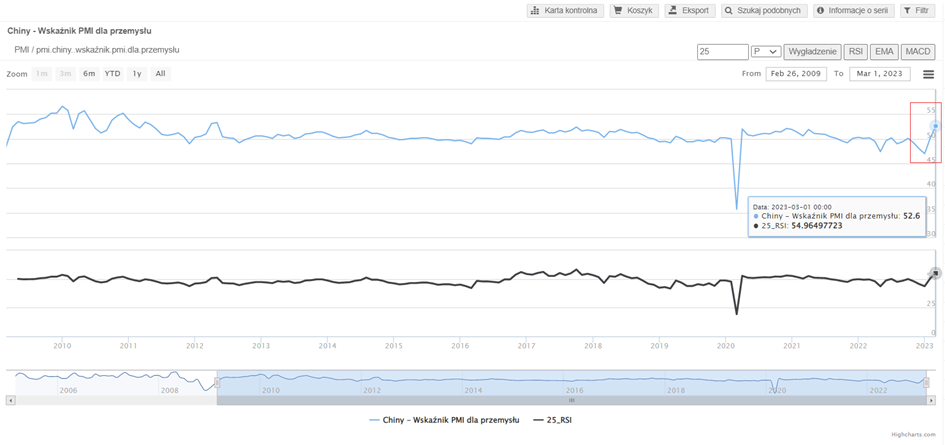

Economic indicators pointing to the beginnings of a possible economic recovery in China (rises to levels above 50 points):