An analysis of the factors affecting the availability of natural gas in Poland in 2023 and the first half of 2024 allows us to conclude that those that support demand reduction, and therefore security of supply, will prevail. The main factors influencing the formation of gas demand.Factors supporting assumptions about reducing demand for gas fuels […]

An analysis of the factors affecting the availability of natural gas in Poland in 2023 and the first half of 2024 allows us to conclude that those that support demand reduction, and therefore security of supply, will prevail.

The main factors influencing the formation of gas demand.

Factors supporting assumptions about reducing demand for gas fuels by mid-2024 among existing customers:

– increasing the share of RES in the energy mix,

– development of technologies and increased energy efficiency of installations powered by gaseous fuel,

– thermal modernization of buildings,

– low level of economic prosperity,

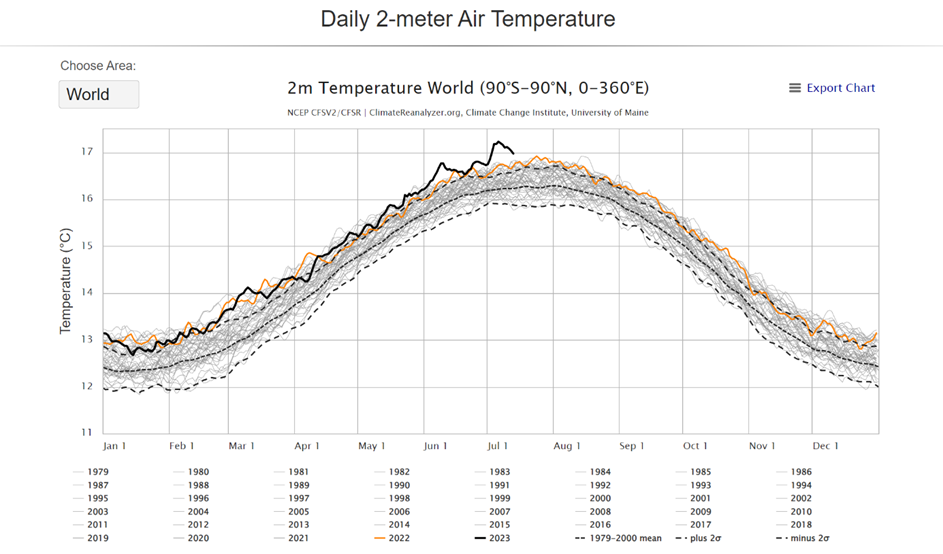

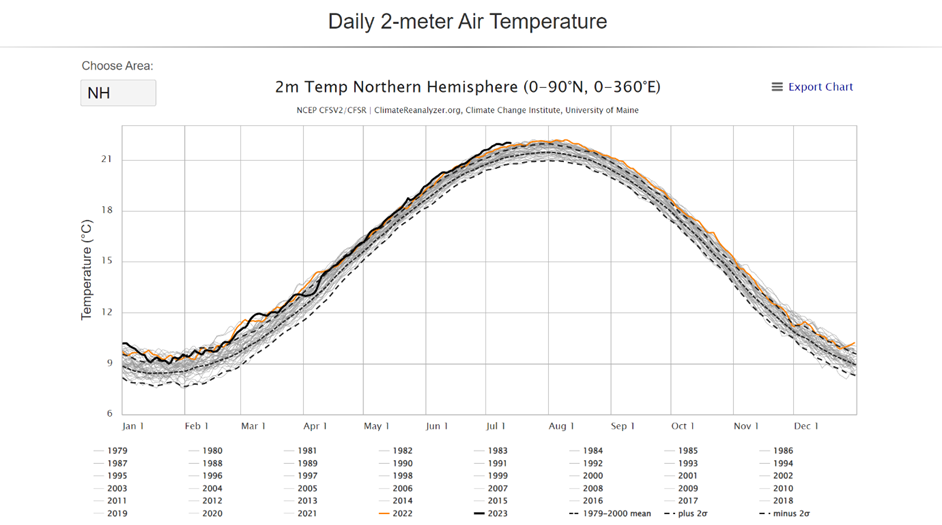

– 24-hour average temperature higher than the multi-year average.

Factors supporting demand growth:

– planned new connections.

In the scenario of expected gas demand in the period 2023-2025, GAZ-SYSTEM assumes a continuation of the energy crisis initiated in 2022 (a decrease in gas consumption by an average of about 16.5% compared to the previous year), related to the general situation in the gas markets: supply constraints and an increase in gas fuel prices.

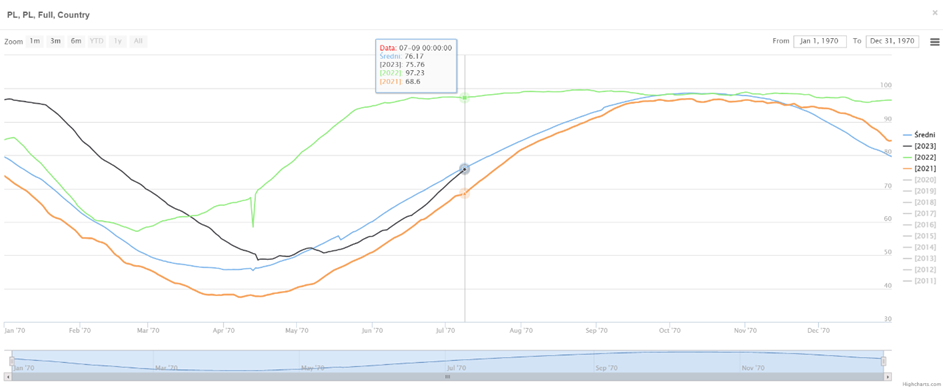

The course of filling gas tanks in Poland in 2023 compared to previous years:

The minimum filling level of about 50 percent , in the second half of April 2023. The level of 90 percent can be reached as early as August. With the expected levels of gas inflow from outside (LNG + Baltic Pipe), the availability of raw material should be assured.

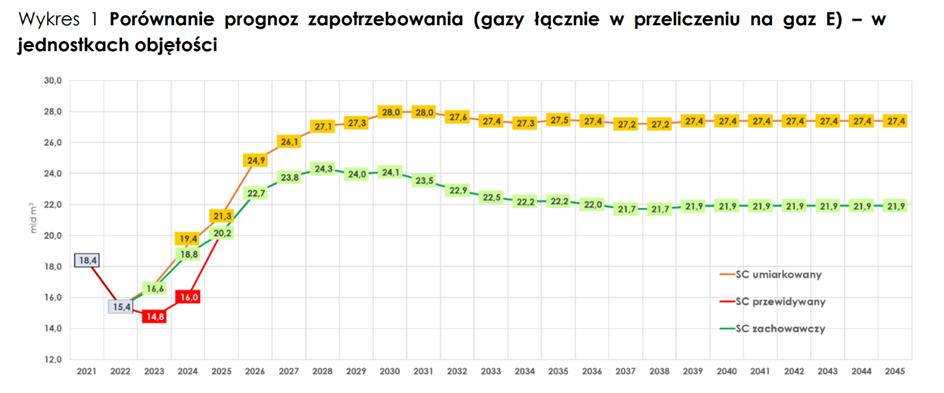

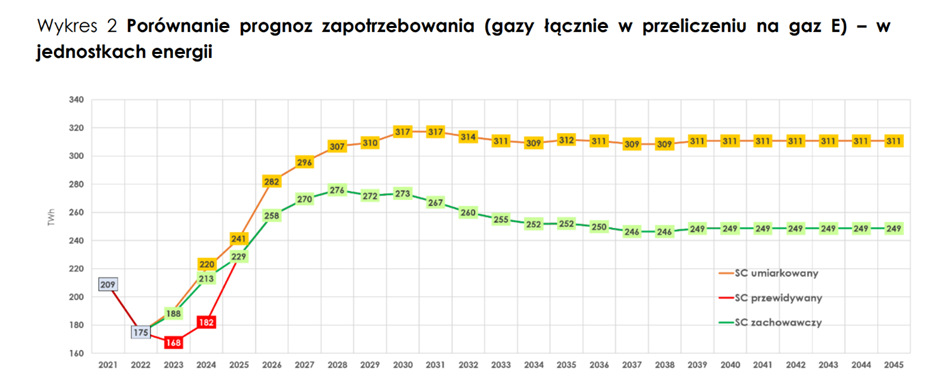

Considered scenarios for the course of gas demand.

In the demand forecasts prepared by GAZ-SYSTEM for the NAP 2024-2033, a breakdown of gas fuel customers into the following basic categories was used:

– Final customers divided into industrial and power customers, divided into power plants, combined heat and power plants and heating plants,

– Distribution customers.

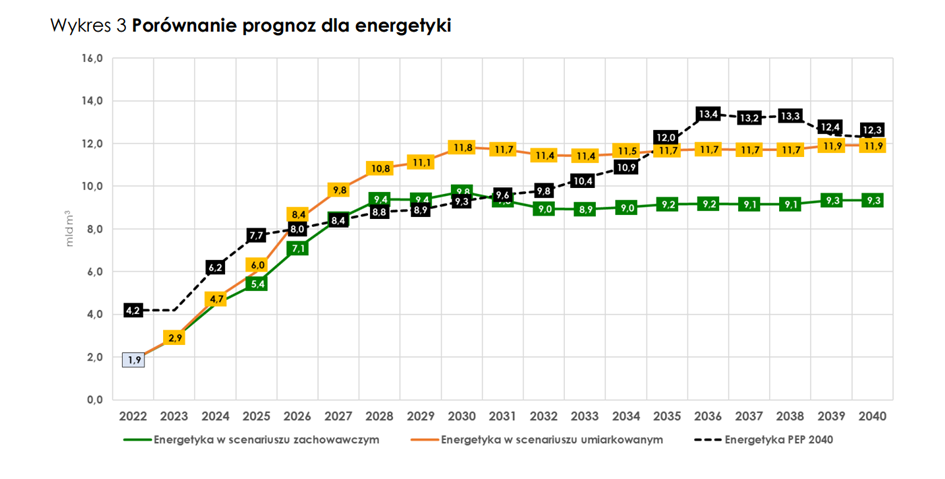

In the case of forecasts for power plants and CHP plants, they coincide with the high EUA price variant of the forecast of gas consumption in the power industry, included in the Energy Policy of Poland until 2040.

2040:

– In the period 2026 – 2031 with a conservative forecast,

– In the period 2039 – 2040 with a moderate forecast.

https://www.gaz-system.pl/dam/jcr:2afd3e4f-9154-4ed3-ac5b-14fb4fd35d2e/kdpr-2024-2033-czesc-a-wyciag-do-konsultacji.pdf

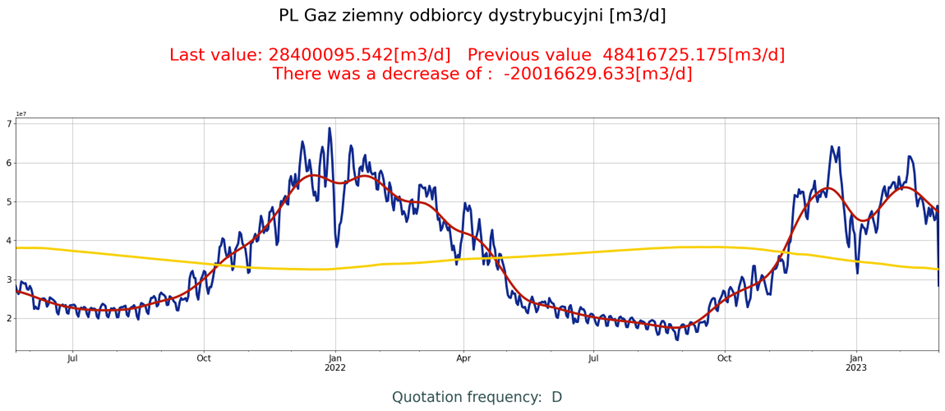

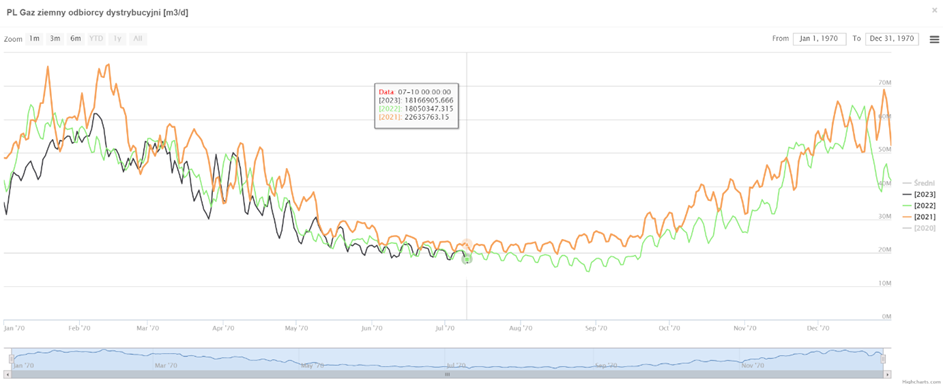

Gas consumption to date in Poland in customer groups:

Gas consumption in Poland – distribution customers [bcm].

| 2022 | 2021 | Period of the year |

| 5.482 | 6.405 | from 01 July to 31 December |

| 12.599 | 14.431 | all year |

Gas consumption in Poland – distribution customers [bcm].

| 2023 | 2022 | 2021 | Period of the year |

| 6.976 | 7.353 | 8.292 | January 01 to July 12 |

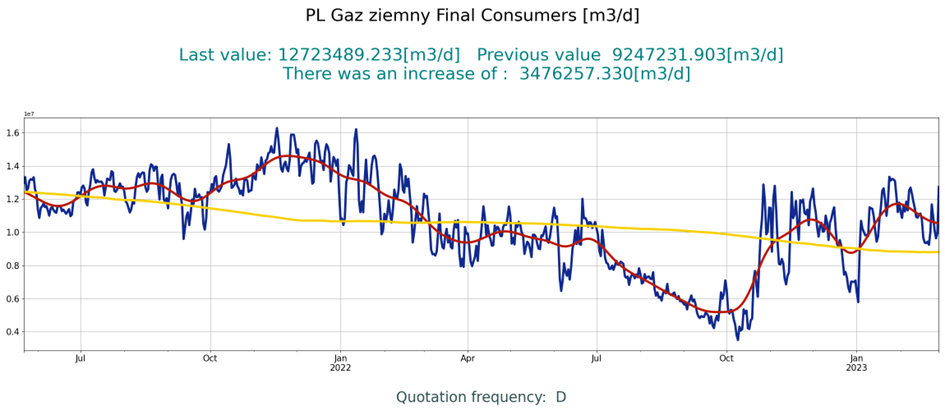

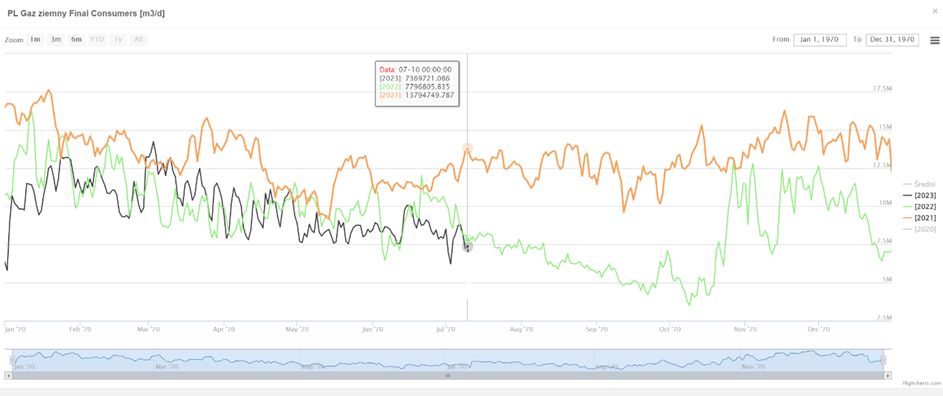

Gas consumption in Poland – Final consumers [bcm].

| 2022 | 2021 | Period of the year |

| 1.416 | 2.435 | from 01 July to 31 December |

| 3.325 | 4.824 | all year |

Gas consumption in Poland – Final consumers [bcm].

| 2023 | 2022 | 2021 | Period of the year |

| 1.907 | 2.014 | 2.542 | January 01 to July 12 |

Poland’s natural gas consumption is clearly declining in major customer groups as of mid-2022.

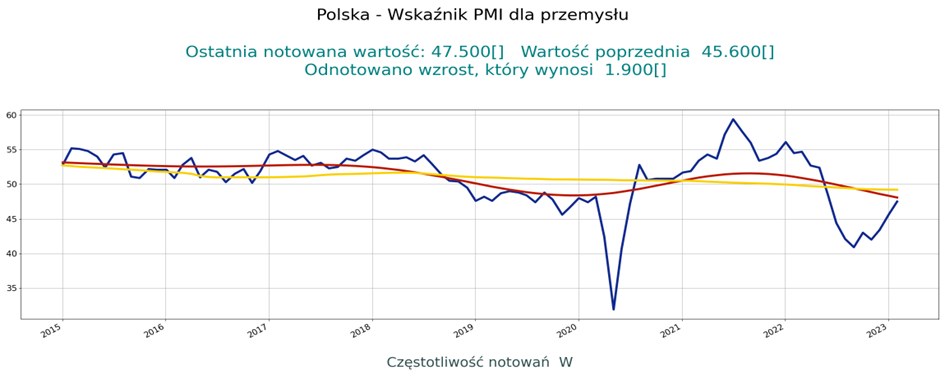

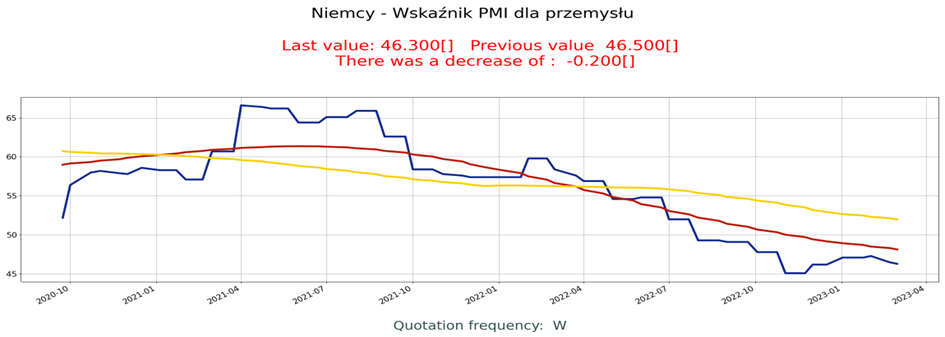

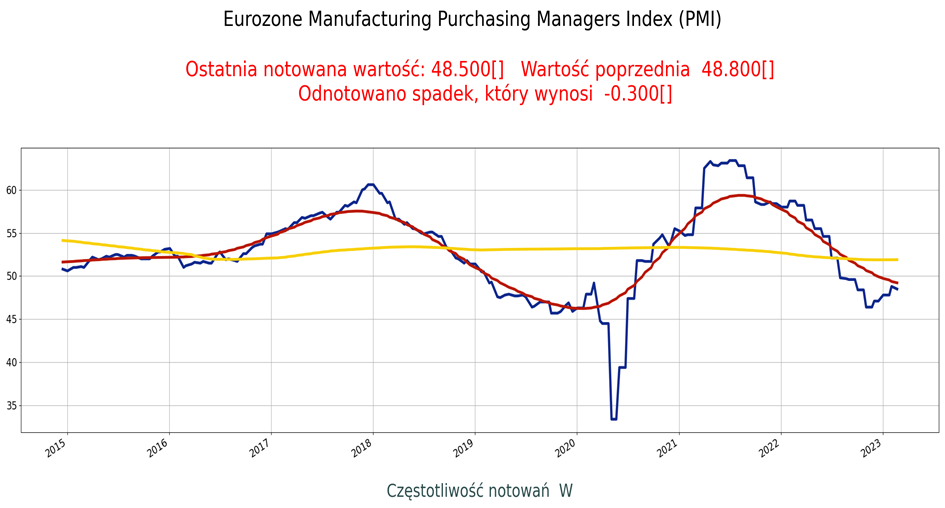

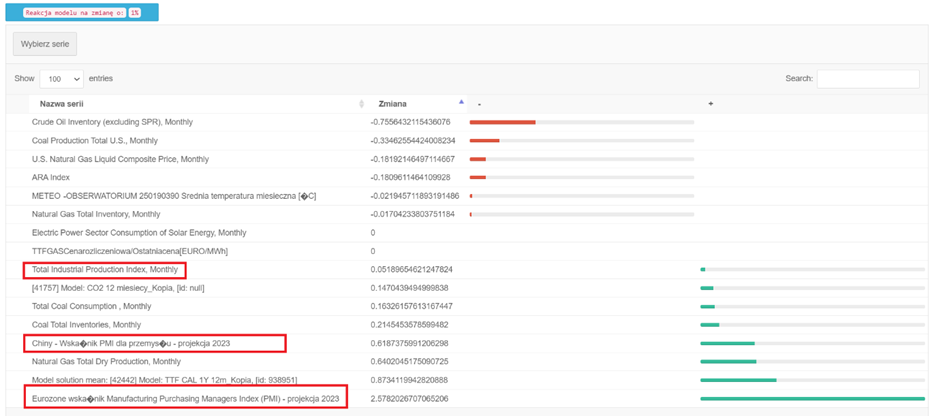

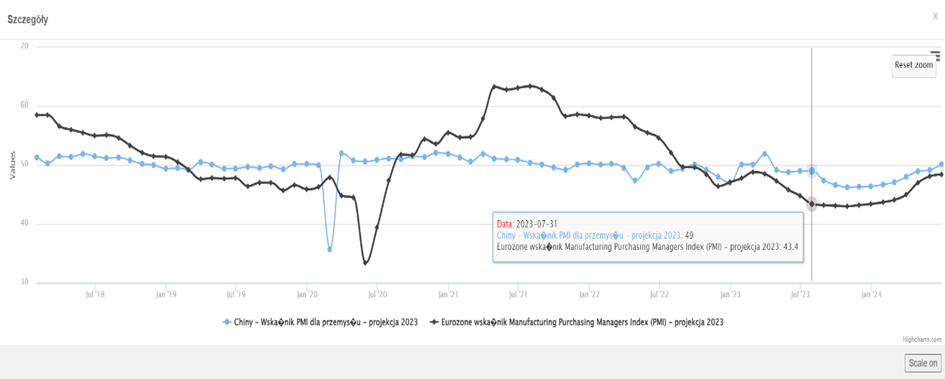

Expectations for industrial activity in Poland and Europe:

Business expectations, after several weeks of growth, have stopped in Europe at less than 50 points. In Germany and France, they recorded sharp declines. In general, they fit the scenario of low growth rates in 2023 in Europe, which supports the reduction in gas demand.

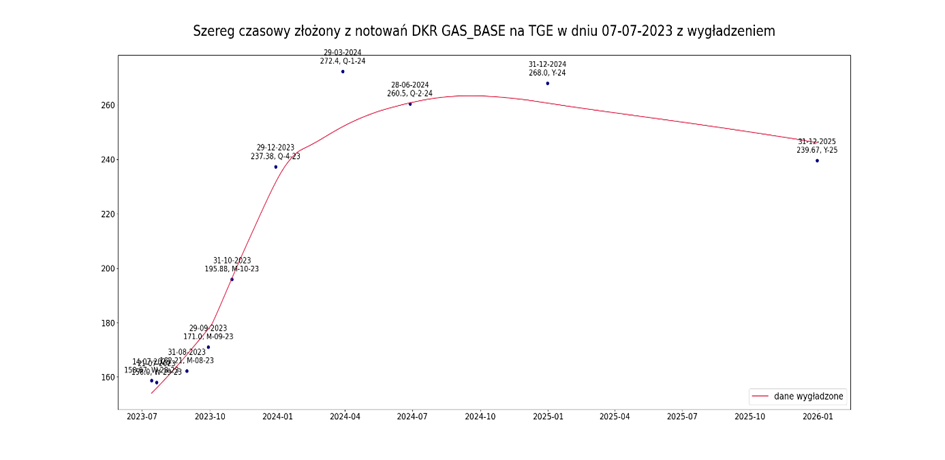

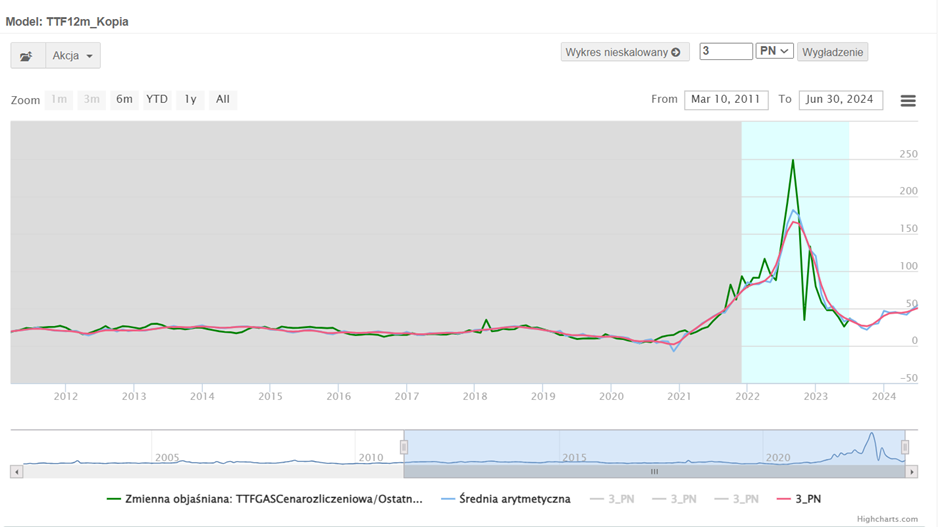

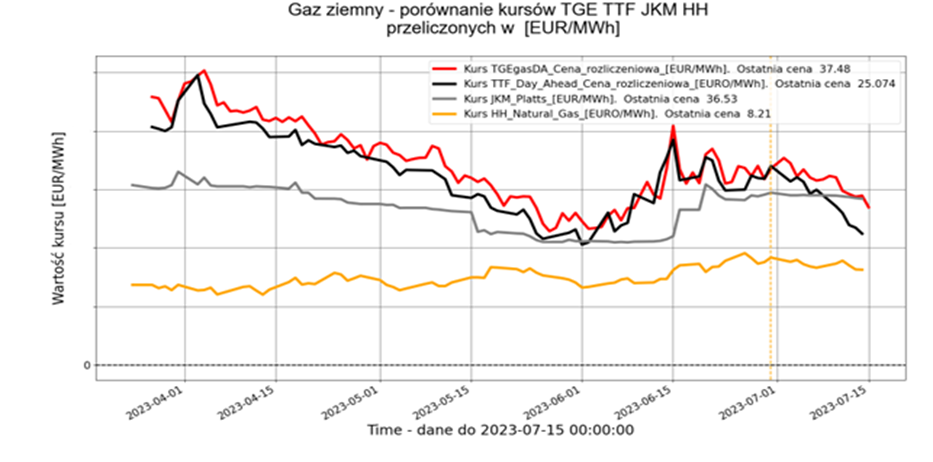

Current expectations for natural gas prices in Poland – the forward curve of natural gas prices in Poland until the end of 2025:

Currently, market participants in Poland expect natural gas prices to increase by about 45% by the end of the year.

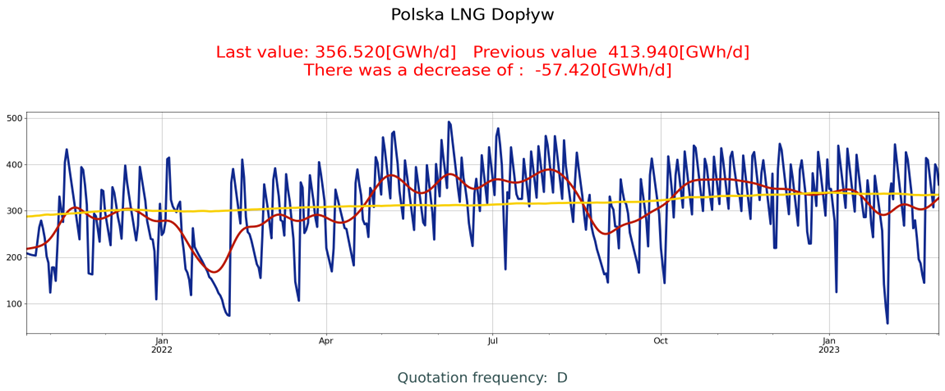

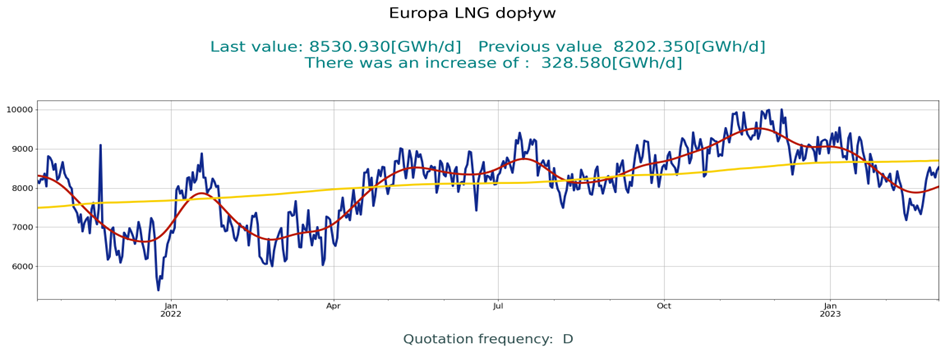

LNG supply to Poland and Europe.

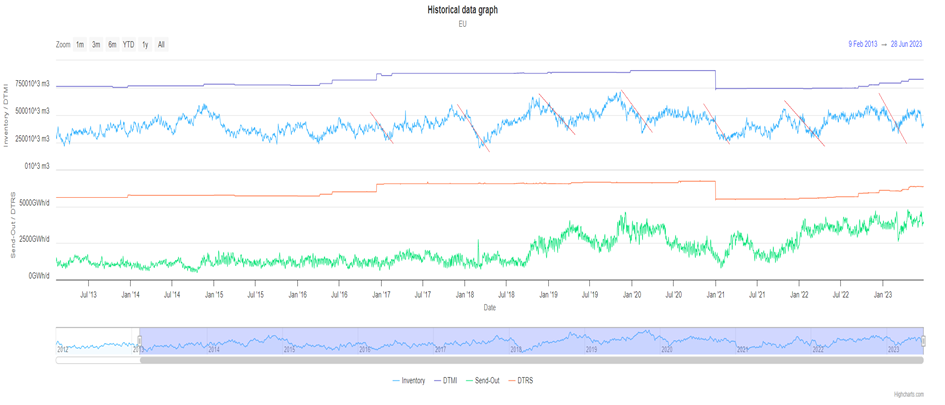

LNG stocks expected to rise:

Cyclically every year, after the decline recorded in IQ, there should be an increase in stocks at LNG terminals in Europe.

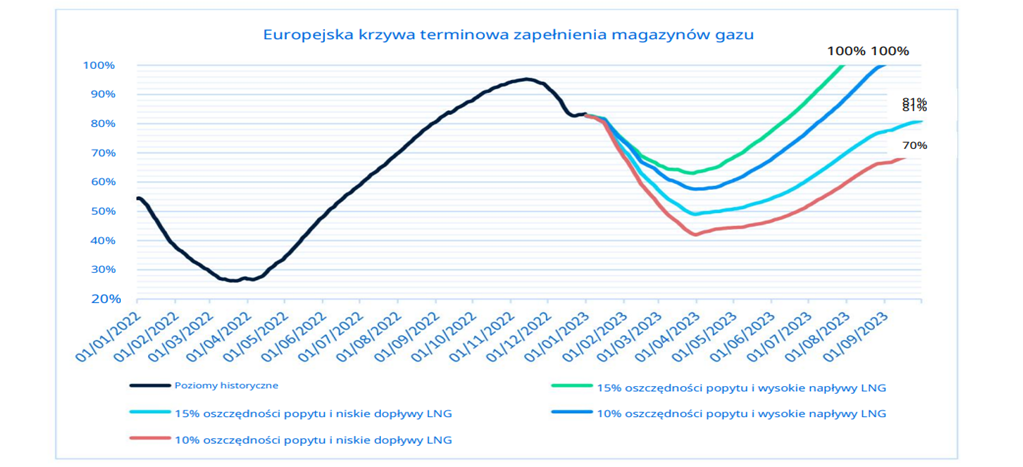

Filling scenarios for underground gas storage in Europe in 2023.

Gas is more likely to remain the engine of European energy markets with supply-demand balance risks persisting.

Demand from China still quite weak, at levels close to 2022. This gives Europe some room for maneuver.

However, any serious revival of demand competition from China or Asia as a whole could quickly lead to price competition.

Prices in European gas hubs remain somewhat elevated compared to previous years, and markets remain vulnerable to upside risk. The loss of Russia as a key primary supplier of pipeline gas and the shift to LNG by sea will increase Europe’s exposure to fundamental factors in the global market.

Looking ahead, it is also unlikely that we will see significant changes on the supply side coming from Russia with reduced volumes. Given this, lower market volatility compared to 2022 is very likely in 2023 and the first half of 2024.

Gas, however, may find support from rebuilding demand patterns in domestic markets. Industrial demand may be bolstered by the recent downward price trend, which will put further pressure on inelastic supply margins in Europe.

Indeed, the possibility of a sharp contango in the forward curve in mid-summer 2023 (as we are currently seeing) should not be underestimated.

If storage fills continue to reach daily highs and LNG continues to reach European shores, spot prices could fall for some time while winter ’23 remains elevated.

Since the beginning of this year, prices in Europe have been below 2022 levels, due in part to an unusually warm winter, high LNG inflows, replenished natural gas stocks and improved nuclear availability in France.

Infrastructure

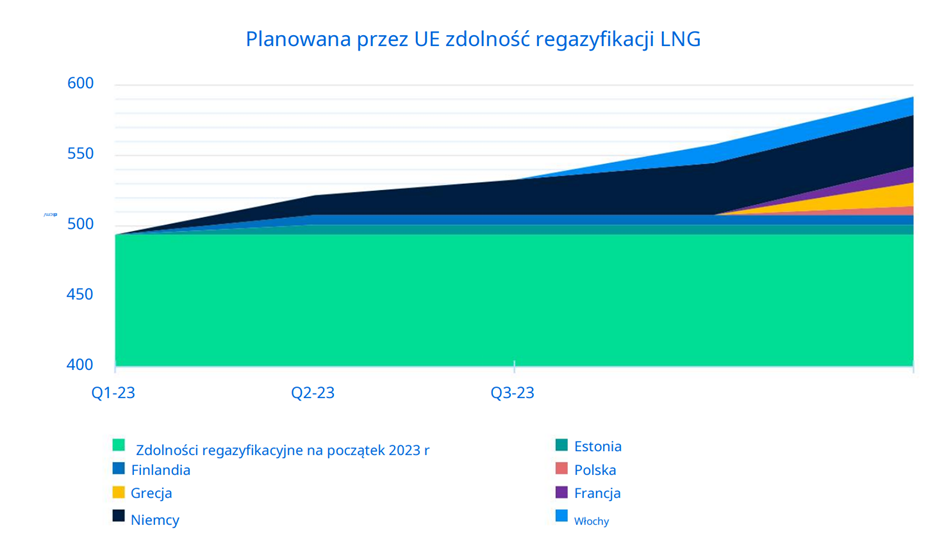

LNG infrastructure in Europe is expected to continue to grow in 2023 and in 2024 , while no major pipeline investments are planned.

In 2023. Germany will continue to expand its LNG regasification capacity. The country’s second LNG import facility, the Deutsche ReGas LNG terminal in Lubmin, opened in mid-January, increasing regasification capacity by 14 million m3/day. The Brunsbuttel LNG terminal will be the next import facility to come online early in the first quarter of 2023. A second FSRU in Wilhelmshaven is expected to come online later in the year.

Similarly, the Inkoo LNG terminal in Finland was commissioned in mid-January. The terminal will not only help Finland’s security of supply, but will also enable gas supplies to the Baltics via the Balticonnector pipeline. Greece, France and Italy also plan to launch FSRUs in the second half of the year. Poland plans to upgrade its existing onshore LNG terminal in Swinoujscie.

Likely cutoff of gas supplies delivered to the EU by transit through Ukraine from early 2025.

The 2019 transit agreements are valid until the end of 2024 and allow Gazprom to export more than 40 million cubic meters of gas per year through Ukraine, bringing Kiev a profit of about $7 billion. (about PLN 28 billion) per year. The war means that bilateral negotiations on their extension are unlikely.

The overland route through Ukraine is one of only two still active pipeline links between Russia and the West. It still accounts for about 5 percent of gas imports to the EU, although this is only a third of the pre-war level.

The cutoff could also come sooner, as Gazprom has warned that its company will halt exports if Ukraine does not abandon its efforts to seize Russian state assets. In doing so, it wants to enforce compensation of $5 billion. (nearly 20 billion zlotys) for energy infrastructure that Moscow illegally expropriated after the annexation of Crimea in 2014.

Gazprom and Ukraine’s Naftogaz are also in dispute over transit fees.

Temperatures in 2022 and 2023 higher than multi-year average:

Ex Metrix Model

We expect a decline in natural gas prices until the end of October , and then an increase, which, however, will be much lower than currently expected by market participants, at around 28% by the end of the year.

The biggest influence in the group of economic factors is currently the economic situation in Europe and China:

PMIs for China and the Eurozone – projections used in the gas rate model:

Comparison of natural gas rates in different markets:

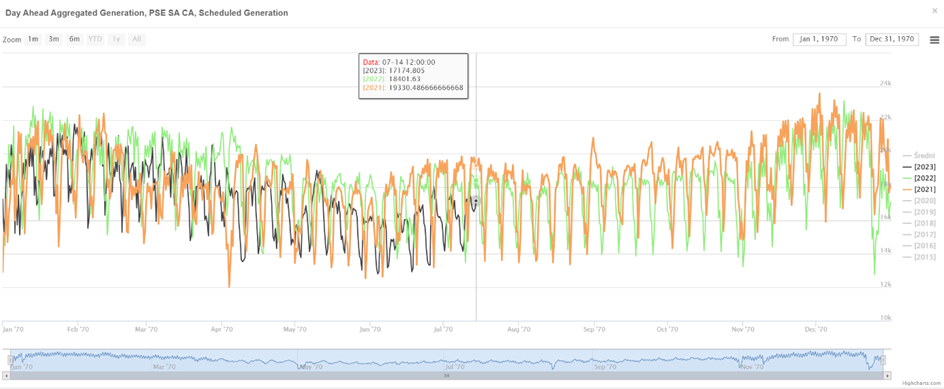

Scheduled generation of power corresponding to expected consumption.

Day Ahead Aggregated Generation, PSE SA CA, Scheduled Generation [MW]:

Amount of energy produced according to scheduled power demand:

Day Ahead Aggregated Generation, PSE SA CA, Scheduled Generation [TWh]:

| 2023 | 2022 | 2021 | Period of the year |

| 80.46 | 85.78 | – | January 01 to July 12 |

| – | 79.32 | 83.03 | from 01 July to 31 December |

| – | 160.39 | 159.66 | All year |

Since mid-2022, energy consumption has been declining markedly, although more slowly than natural gas consumption over the same period.